Indian Insurance Comparison Sites: A One-Stop Shop for All Your Insurance Needs

3 min read

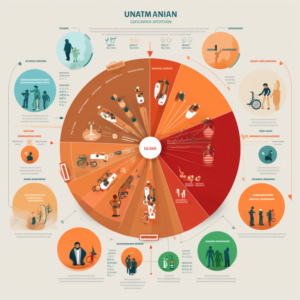

In recent years, the Indian insurance market has witnessed significant growth and development. With a plethora of insurance companies offering various policies and coverage options, it can be overwhelming for consumers to find the best insurance plan that meets their specific requirements. This is where Indian insurance comparison sites play a crucial role.

Insurance comparison websites have emerged as a revolutionary platform, providing consumers with the convenience of comparing different insurance plans side by side. These sites enable users to make an informed decision by evaluating the policies offered by various insurance companies, thereby simplifying the process of choosing the right insurance plan.

One of the most compelling benefits of using an Indian insurance comparison site is the time and effort it saves. Traditionally, individuals seeking insurance had to engage in extensive research, contacting multiple insurance providers, and compiling information manually. However, with comparison sites, users can simply enter their requirements and get access to a comprehensive list of insurance plans within seconds. This not only makes the process more convenient but also ensures that users have all the necessary information at their fingertips.

Furthermore, Indian insurance comparison sites bring transparency to the insurance industry. These platforms display details such as policy premiums, coverage limits, exclusions, deductibles, and other vital information that are crucial for decision-making. By facilitating a side-by-side comparison, users can easily identify the strengths, weaknesses, and unique features of each policy, enabling them to make an informed choice based on their needs and budget.

Another advantage of using insurance comparison sites is the ability to customize search results. These websites often have advanced filters and search options that allow users to specify their requirements, such as age, gender, coverage type, policy tenure, and more. This personalized approach ensures that users get tailored results that suit their specific needs, saving them from the hassle of sifting through irrelevant policies.

Moreover, Indian insurance comparison sites act as a knowledge hub by providing educational resources and informative articles. These platforms offer insights into insurance concepts, policy terminologies, and expert advice to help users understand the complexities of insurance. This empowers individuals to make well-informed decisions and have a better understanding of the policies they choose.

Additionally, insurance comparison sites also provide users with the option to read and leave reviews. These reviews, often based on first-hand experiences, provide valuable insights into the overall customer satisfaction, claim settlement process, and customer support offered by different insurance companies. By reading reviews, users can gauge the reliability, trustworthiness, and track record of an insurer before making a final decision.

It is important to note that insurance comparison sites do not function as insurance brokers or agents. They act as intermediaries, bringing together insurers and consumers in a convenient online platform. Users can compare policies, check premiums, and access all necessary details; however, the actual purchase of insurance is made directly through the selected insurer’s website or by contacting their representatives.

In conclusion, Indian insurance comparison sites have transformed the insurance buying process in the country. With their user-friendly interfaces, comprehensive options, and personalized search criteria, these platforms enable users to find the most suitable insurance plan at competitive prices. By bringing transparency, convenience, and comprehensive information, insurance comparison sites have become the go-to resource for individuals seeking insurance, ensuring a hassle-free and smart insurance buying experience.